Table of Content

Before hiring a contractor in Tennessee, be sure to get at least 3 detailed bids. Quality contractors will take the time to explain their budget proposal, and help guide you through the estimate process. Be wary of an abnormally low bid, they are not worth the risk.

For 30 years, Country Style Homes, Inc has assisted hundreds of families to find their special homes. We provide modular homes, single-wide homes, and double-wide homes. These homes are highly customizable with a wide variety of offerings in size, a number of bathrooms, and a number of bedrooms. Plus, you can customize these modular homes with porches and decks if you would like!

Country Homes, Inc Projects

Building permit records show that Country Homes, Inc has worked on 10 permitted projects. BuildZoom hasn't received any reviews for Country Homes, Inc. Their BuildZoom score of 0 does not rank in the top 50% of Tennessee contractors.

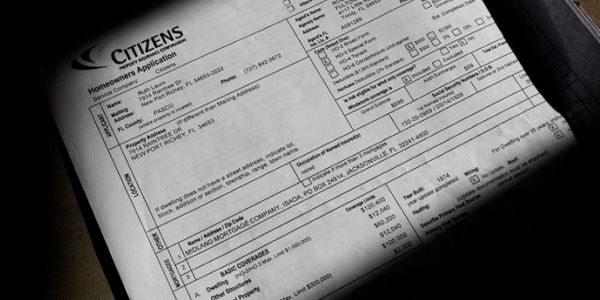

If you are looking for remodeling ideas, you can browse hundreds of beautiful photos of work performed by our general contractors. The best way to use BuildZoom is to let us recommend contractors for your remodeling projects. In order to become licensed in Tennessee, contractors must submit a reviewed or audited financial statement prepared by a licensed independent accounting firm. To obtain an unlimited license, the contractor must show $300,000 in working capital.

Business Hours

TypeContractorClassRESIDENTIALAccording to the The City of Brentwood, TN, the status of this license was at one point cancelled. We recommend getting multiple quotes for any construction project. Our free bidding system will get you quotes from Country Homes, Inc and 2 other top contractors. BBB Business Profiles are provided solely to assist you in exercising your own best judgment.

As a home builder with over 25 years of experience, we have help make fantastic neighborhoods surrounding the Essex County, Massachusetts area. A first impression In the heart of the city, the innovative Westend Suites residential complex of Opera One ag extends with a breathtaking view over the skyline. As a matter of policy, BBB does not endorse any product, service or business. BBB Business Profiles generally cover a three-year reporting period. If you choose to do business with this business, please let the business know that you contacted BBB for a BBB Business Profile. If you're looking to sell your home,we can provide you with all the tools you need, contact us for more information.

Frankfurt am Main, Villas and Luxury Homes for sale - Prestigious Properties in Frankfurt am Main

By volume building and purchasing, we are able to pass on the savings to the customer. That is why Contry Homes can continually offer a quality built home at the most affordable price. This "total package" of outstanding value, quality and service makes a Contry home a wise investment. Manufactured homes are great for rural areas and areas that have fewer homes.

Common amenities in Frankfurt am Main are Terrace, Balcony, Garden and Fitness Center / Gym. We specialize in new construction single family and condo/townhomes, additions and renovations. We offer a complete line of modular & manufactured homes and can add to them custom on-site work, such as garages, porches and more. Use our remodeling calculator to get a ballpark estimate for your project. If you're ready to hire, use our bidding system to get actual quotes from local contractors.

our communities

You can use our building permit search to see the contractors who are active in your neighborhood and the projects currently taking place. Licensed contractors in Tennessee must obtain a surety bond before performing construction work on residential properties. A home owner may file a claim against this bond to recoup losses or damages incurred during the construction project. Contry has a wide selection of popular floor plans to choose from or we can design and moderately custom build your new home to suit your budget and lifestyle. Members of our new construction team who are knowledgeable in the communities and home features will be on hand to assist.

Town & Country Homes, Inc. offers 1 free consultation to get you started on building the home of your dreams. BuildZoom is a database of every licensed contractor in the United States. We work hard to figure out who the great contractors are, and who the bad contractors are. When it comes to major construction work or even minor alterations to your home, hiring the wrong contractor could result in incomplete or defective work. You may even find yourself dealing with huge liability claims.

We only use the highest quality materials, so you know when you shop with us, you know you’re getting the best. When you choose us, you can expect quality, sturdy homes, affordable prices, and excellent customer service. When you give our modularhomes company a call, you’ll be connected directly to our friendly staff, so you can expect immediate assistance to your inquiry. When you give our mobile homes company a call, you’ll be connected directly to our friendly staff, so you can expect immediate assistance to your inquiry.

You can call them whichever name you prefer, but a home is still a home. Purchasing a manufactured home is just the same as purchasing a traditional home. The loan you get depends on a variety of factors, such as your credit, whether you own a property already, or plan to lease or purchase the property you are looking at. Manufactured homes are a great investment just like site-built homes. Spending money on rent cant drain your bank account, build equity is a great way to build for your future.